Proc. of Second World Avocado Congress 1992 pp. 595-602

Returns to Scale of

the Spanish Avocado Industry: The Dynamics of the Productive Structures

Javier Calatrava

Department of Agricultural Economics and Sociology, Center

of Agriculture Research and Development, Apartado 2027, 18080 Granada, Spain

Federico Giardin

Agricultural Extension Service, Almunecar, Granada, Spain

Abstract. From primary information concerning the

productive structures of the basic type of avocado orchard at the Granada coastline,

a return analysis was made

considering two different orchard sizes and two marketing structures. From this

analysis some results are obtained concerning both the scale effects in

producing and marketing avocados and the evolution of the orchard sizes which

has taken place since 1970. Some comments on the evolution of production costs

and prices are also made.

The difference between the price received by the producer and the cost of production of the avocado in Spain has continued to decrease over the last fifteen years. This decrease was foreseen to a certain extent since several factors have been influencing the evolution of the market price and production cost, as follows:

(i) The European avocado market, and also the Spanish market, have been undergoing a strong structural change. The market, pushed by a growing supply, has shifted from a position of equilibrium with the avocado as an exotic or luxury product to one where the avocado is consumed on a relatively frequent basis (already very frequently in France). A resulting fall in the real price of the avocado has occurred.

(ii) Primary input costs have risen sharply during the last fifteen years. The cost of manual labor has increased greatly as a consequence of economic development in the avocado producing regions and the adjustment of salaries in response to the inflation that has been occurring during this period. The evolution of water costs has been very important also, especially in the zone of Almunecar. The increases in land prices over the last several years have been motivated not only by iogical expectations of changes in the money value and of expected income from undertaking agrarian activities, but also from other factors such as land speculation and investments of black-market money arising from activities including: construction, appreciation of real-estate values, and services, etc.

(iii) The costs of other inputs employed in the production of the avocado: light machinery, fertilizers, and pesticides have also suffered significant increases, particularly between 1977 to 1985. Some of these years, the price index of these production inputs had increases of up to 12%.

The factors, discussed previously, clearly show the interest to carry out an analysis of the structure and evolution of avocado production costs and its profitability and to search for ways to decrease production costs or increase prices received for avocados. However, very few studies relating to avocado production costs and the income-generating potential of avocado plantations exist in Spain.

The existing studies are limited to those of Servicio de Extension Agraria (SEA) (various years), Calatrava et al. (1987), and Calatrava and Garcia-Faraco (1989).

By analyzing the structure and evolution of the production costs for one hectare of avocados, the production factors which could be utilized to produce scale effects (with respect to the orchard size) were determined. The effect of scale was estimated through a return analysis, taking into account possible variations of the sale price of the avocado and different modes of marketing it. The following analysis was carried out in reference to the type of orchard in the zone of Almunecar (Granada).

Materials

and Methods

The analysis of the cost structure focuses on two different farm sizes, of 1 ha and 4 ha, respectively. Both sizes have the typical characteristics of avocado orchards along the coast of Granada. Avocados in this region are generally cultivated on fairly steep slopes (around 15-20%), utilizing terraces. Most orchards do not have their own wells, which makes it necessary to buy the water rights in order to irrigate. A drip system is used for irrigation. After the purchase of the land, the irrigating system is installed, and the land is prepared and then planted.

The effects of the cost comparisons of the avocado production from the previously described orchards were measured with 1978, 1985, and 1991 prices. Technological change has been considered to be constant between 1978 and 1991; although that is not exactly true since using machinery to work the land was a widespread practice in 1978 but today it is considered uncommon. We have analyzed the year 1978 with the technology of 1991 in order to compare the production costs of 1978 with those pertaining to productive structure used today.

For the 1991 prices, the following investment scheme variations were taken into account:

(a) Different producer sale prices for avocados, oscillating between 80 and 190 pts/kg.

(b) The marketing of the avocado in the "alhondiga" (a traditional market of Arab origin based on the auction or barter) or by an associative entity (delivering the product to its area of sale). With this second case, a surcharge of 10% of the final price is added but it will not be collected until the corresponding avocado harvest is liquidated. Since the collection of this increased price is delayed for a period of time, it therefore must be taken into account in the investment analysis.

In regards to the cost/benefit analysis, the costs of land purchase and purchase of water rights are never included in the initial investment, nor is the cost of terracing. The reason for not including these elements is because the initial investments in infrastructure are not recuperated through the activity of cultivation of avocados, but rather pertain to another form of investment: land purchase and preparation, which is much more profitable than the previously mentioned agricultural activity.

To compare the money in constant terms, the change in the value of the peseta according to the cost of living index of the INE between 1978 and 1990 was utilized. The technical coefficients pertaining to the cultivation were taken from real avocado orchards in the zone of Almunecar.

Results

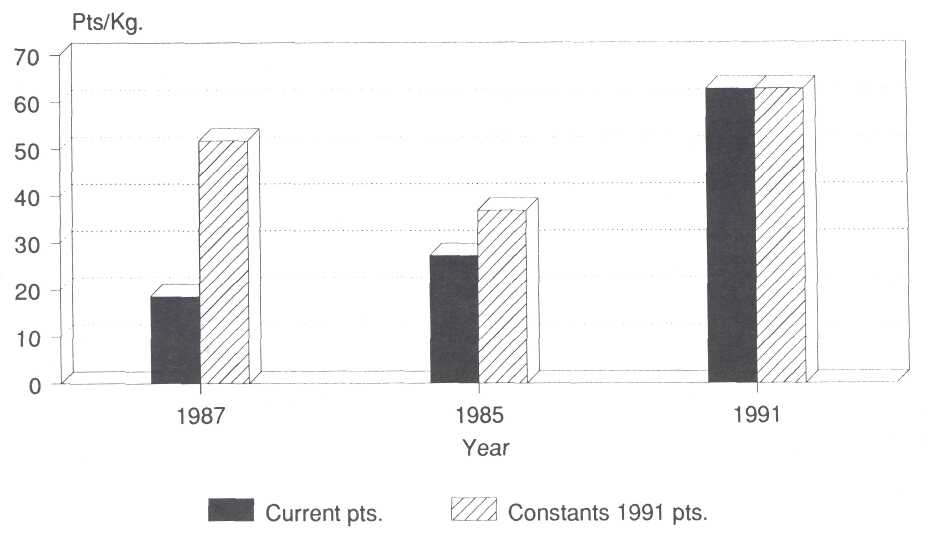

Evolution of costs and prices. In Table 1, some comparative figures of different

costs can be observed for the three years being analyzed. Table 1 shows

significant cost increases in nominal terms, particularly between 1985 and

1991. In real terms, the input prices decreased between 1978 and 1985, but later

the real costs rose notably. The rise is even more evident when we analyze the

expenses per kilogram of avocado (shown also in Figure 1).

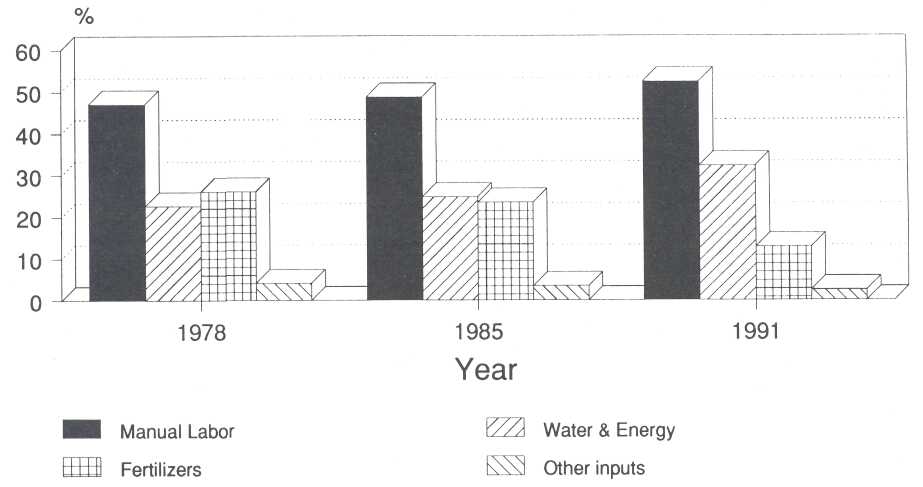

Figure 2 represents the evolution of the

percentile structure of variable production costs. There is a great increase in

the percentile cost of water and energy in terms of unit cost in the same way

there is a significant increase in the percentile cost of manual labor between

1978 and 1991. In contrast, there is a decrease in the percentile cost of

fertilizers and other inputs. Therefore the cost increases of water and manual

labor are primarily responsible for the greatly increased avocado production

costs over the last fifteen years.

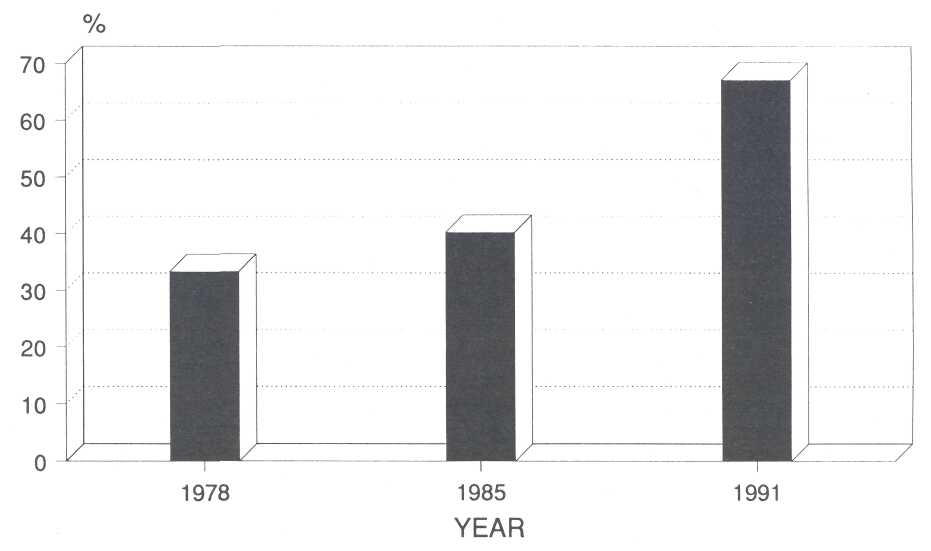

The cost increases discussed above can not explain by themselves the drop of avocado production revenues (Calatrava and Garcia-Faraco, 1989), if it was not for the decreases in real sale prices. Figure 3 shows schematically the evolution of the percentage of the price that is equal to the cost of production: being 33.3% of the sale price in 1978, 40.24% in 1985, and 67.09% of the sale price in 1991. For 1991, the estimated average price of the avocado in the alhondiga was 110 pts/kg, although the 1990/1991 harvest has not been completed. For 1978 and 1985, the average prices were considered to be those between October and May of the harvests of 1977/78 and 1984/85 respectively. The trend, therefore, is rising alarmingly. In order to stop this trend, as shown, there are two different possibilities: (i) obtain a higher price for the avocado or (ii) try to decrease production costs.

Since avocado prices are not really rising

by themselves, the ways of achieving higher prices for the farmer are limited

to the following strategies: (i) improving the quality, selection, and visual

presentation of the avocado; differentiating the avocados using those

standards, or through using alternative ones (organically-grown), from the rest

of the supply; (ii) trying to diversify the supply over time by selling part of

the crop during periods of decreased supply and higher price thereby raising

the average price received for the avocado; and (iii) improving the marketing

process by forming cooperatives, Agrarian Transformation Societies (SAT), or

other marketing entities and therefore, improving their economic position

through the value added to the product.

Trying to decrease the cost of production of the

avocado is not easy since, as we have discussed previously, the prices of the

two basic inputs water (scarce in this region) and manual labor (subject to inflation

and labor agreements), are the ones that propel the rising production costs.

The mechanization of certain jobs, such as picking the avocados, is not

possible given the topography of the land in the region of Almunecar. The only

possibility is to consider the advantages coming from economies of scale

related to the orchard size and to increase this size either at the level of

the individual grower or through producer associations.

Factors leading to economies of scale. Carefully studying the distinct components of the costs involved in preparing the land, installing irrigation systems, planting, and cultivation; the following elements were seen to benefit from economies of scale.

(i) Construction of a reservoir for water storage.

(ii) Storehouses.

(iii) Mechanized sanitary treatments and pesticide application via mechanized sprayers.

(iv) Permanent irrigation pump systems.

(v) Utilization of small tools and machines.

(vi) Utilization of full-time labor.

(vii) Marketing costs.

The possible effects of economies of scale on the purchasing of inputs, transportation, etc. were not considered. Neither was the possibility of obtaining lower prices per unit of land when purchasing larger amounts of land. The purchasing of land and the construction of permanent infrastructure were not considered in the investment of the cultivation of avocados, as they have to be included as an integral part of the investment in land purchase and basic preparation, which from an economic standpoint was much more worthwhile.

Orchards of 1 ha and 4 ha respectively were used in the analysis. The average size of avocado orchards in Spain in 1991 is 2.16 ha (It was slightly above 1 ha in 1981). In the region of Granada it was less then 2 ha and around 3 ha in the area of Malaga. Today an orchard of 1 ha is considered to be small (although they exist in abundant numbers), while a 4 ha orchard is considered large but not excessively.

Considering the previously discussed elements giving rise to economies of scale on operations of 1 ha and 4 ha, scale effects were detectable on all the elements with the exception of marketing costs and the utilization of full-time manual labor. For example, the cost to construct a reservoir for a 4 ha operation reduced the cost per hectare by 25% compared to the investment required to build a reservoir for a 1 ha operation.

In 1978 and 1985, it was economically viable to employ full-time manual labor on a 4 ha operation, but as of 1991 it is no longer advisable due to the current relationship between the salary of the full-time worker( 103-108 pts/month) and the salary of the seasonal laborer (500 pts/hour). The salary for the seasonal worker per hour is practically the same as the full-time employee. By considering strictly the duties involved in cultivation, a full-time employee would begin to lower the total cost of production/ha of avocados in an operation of at least 6 ha. However, if this laborer in the off-season could provide security for the orchards, clean, and make small repairs amounting to 18.9% of the total necessary cultivation work; then it would become economically viable to employ this worker on a full-time basis on an operation of 4 ha and larger.

In regards to marketing, it would be necessary to have an orchard of at least 20 ha before it would economically viable to consider constructing a storehouse for performing some post-harvest manipulations and the initial steps of the marketing process, adding in this way some sale value to the product. Therefore, it would be worth it to consider marketing the avocado crop through a cooperative, as an alternative to the alhondiga, which was the marketing system considered in the later analysis of investment.

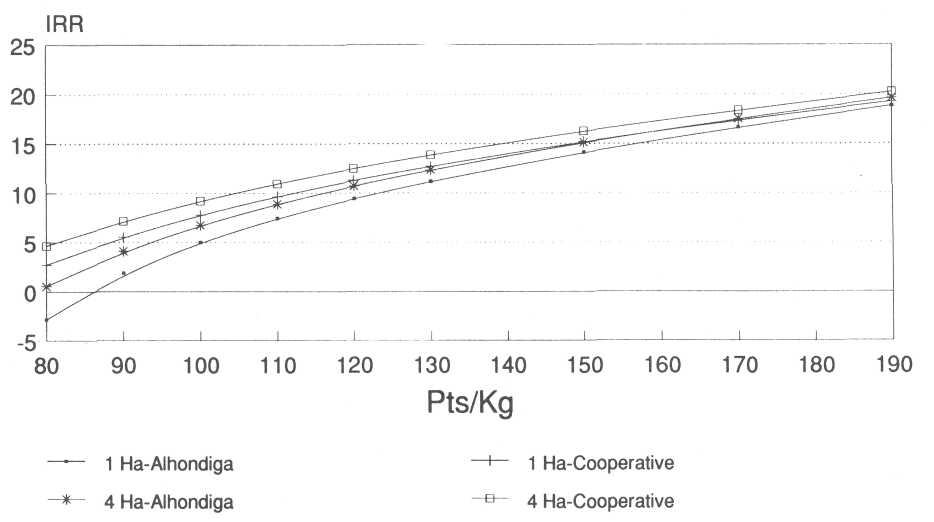

Return analysis. At first, all the initial investments for the avocado were included for the calculation of the internal rate of return (IRR) with the exception of the land purchase, costs for obtaining the water rights, and the development of permanent infrastructures. The benefits were analyzed by varying the parameters that appeared in the methodology and with a discount rate of 12%. The type of orchards analyzed are as follow: 1 ha marketed at the alhondiga (1A); 1 ha marketed at the cooperative (1C); 1 ha (of 4) marketed at the alhondiga (4A); and 1 ha (of 4) marketed at the cooperative (4C).

The net present value of the investment only forms positive values for prices of 190 pts/kg in the cases 1-A and 1-C, and for prices of 170 and 190 pts/kg in the cases 4-A and 4-C. The remaining IRR values that were obtained are smaller than the discount rate of 12 %, and even for prices less then 100 pts/kg, had negative IRR values.

Given the current levels of average prices and considering past results, it is unthinkable that active avocado cultivation could recuperate the estimated investment.

A second analysis considered only the investment of developing the operation: the installation of the irrigation system, the purchase of small tools and machinery, and the pre-planting and planting expenditures. The analysis of the investment was made utilizing four case studies.

With the discount rate at 12%, the net present value begins to be positive starting at 130 pts/kg of avocado for 1A, 120 pts/kg of avocado for 1C, 120 pts/kg of avocado for 4A, and 110 pts/kg of avocado for 4C.

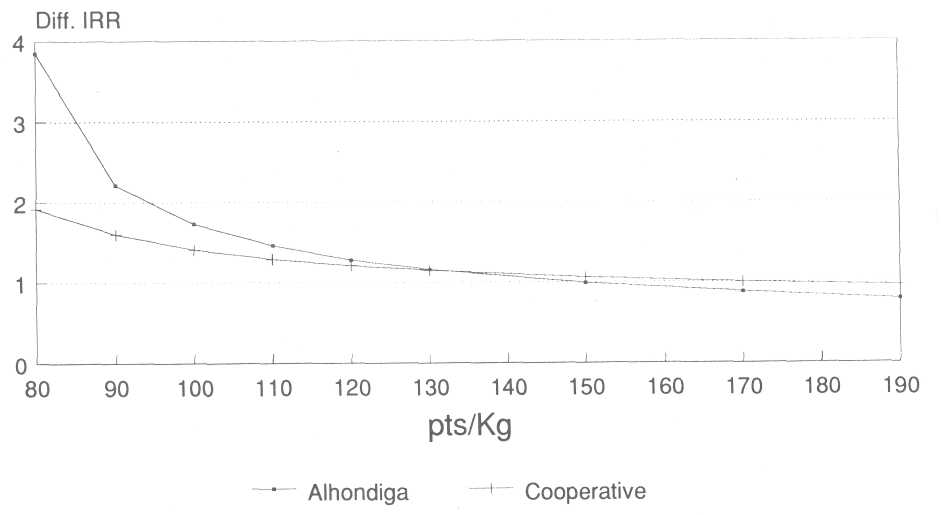

Figure 4 shows the evolution of the IRR as a function of the price received by the producer. The effect of scale, measured as the difference between the internal rates of return, is reflected in Figure 5. From this, it is easily deduced that:

(i) The economy of scale is important.

(ii)

This effect is greatest under the most unfavorable revenue conditions and, for

this reason, the narrow margin between the price and production cost forces one

to think about profiting from the effects of scale.

(iii) Revenue from avocado production, while positive is very low at actual level of prices (100-120 pts/kg).

(iv) There is a positive effect on marketing avocados through cooperatives.

The increase in the average size of the avocado orchards that has occurred over the last ten years is important in this sense and it is easy to predict that the dynamics of the productive structures will develop into even larger sized orchards in the near future. The small plantations will logically have to disappear in the immediate future, unless associative movements (scarcely 2% of the avocado producers belong to such associations today in this region) begin to take place among producers with an emphasis not only on marketing, but also the sharing of resources.

Literature Cited

Calatrava J., J. Garcia-Faraco, L. Delgado, and

E. Alcala-Zamora. 1987. The relationship

between producer prices and costs of the Spanish avocado as a parameter to

forecast future supplies. S. A. Avocado Grower's Assn. Yrbk. 10:85-89.

Calatrava J. and J. Garcia-Faraco. 1989.

Análisis dinámico de rentabilidad de plantaciones de aguacate en el literal

mediterráneo. Investigación Agraria. Economia Vol. 4.

Servicio de Extension Agraria. (SEA) Estudio de

explotaciones tipo subtropicales. Internal

work: documents not published.

|

Table 1. Evolution of various expenditures

for an operation of 1 hectare of avocados on the coast of Granada. (Above in

nominal pesetas and below in parenthesis in 1991 constant pesetas). |

|||

|

|

Year |

||

|

Expenditures |

1978 |

1985 |

1991 |

|

Expenditures: land

purchase & preparation, storehouse, irrigation systems, purchase

machinery, planting. |

2,564,905 (7,135,000) |

4,492,223 (6,082,507) |

7,061,100 (7,061,100) |

|

Expenditures:

irrigation system (including water rights & deposit) storehouses,

machinery purchases planting cost (including preparing terraces &

fertilizing). |

1,789,785 (4,979,181) |

3,3033,357 (4,107,189) |

5,061,100 (5,061,100) |

|

Planting Cost: |

224,785 (625,436) |

359,357 (486,572) |

656,100 (656,100) |

|

Annual Fixed Cost: (No

payment for depreciation included) |

9,779 (27,205) |

14,946 (20,237) |

32,907 (32,907) |

|

Variable Cultivation

Cost (annual) at Full Production (equal to 10 metric tons/ha.) |

176,325 (490,542) |

257,357 (348,467) |

595,150 (595,150) |

|

Total Cultivation

Expenditures (fixed + variable cost) per kg of product. |

18.61 (51.78) |

27.23 (36.87) |

67.72 (62.72) |

Figure 1. Evolution of avocado production cost (variable + fixed annual). Data taken from the area of Granada.

Figure

2. Evolution of the variable production

cost structure for avocados. Values

taen from Granada and refer to a 1 ha operation.

Fig.

3. Evolution of avocado production cost as a percentage of the price to

producers, including commission to the alhondiga. Values taken from Granada.

Fig. 4. Internal rate of return for 1 ha of avocado as a function of the price to the producer. Values taken from Granada.

Fig. 5. Scale effect on avocado production (operations of 1 and 4 hectares), measured as internal rate of return differences and as a function of prices received by producers.