Proc. of Second World Avocado Congress 1992 pp. 585-594

The Structure of the Spanish Domestic Market for Avocados:

Comments from a Consumer Survey

Javier Calatrava

Department of Agricultural Economics and Sociology, Center

of Agriculture Research and Development, Apartado 2027, 18080 Granada, Spain

Abstract. The paper deals with an analysis of

Spanish avocado consumption based mainly upon a survey of 1,099 consumers. The sample was stratified into

different regions and divided into metropolitan, urban, and rural zones; as well as different neighborhoods within the largest metropolitan areas.

From this analysis, some preliminary results were obtained concerning several

consumer characteristics and opinions. In addition, some comments are made

regarding the structure of the Spanish avocado market and potential of the

Spanish avocado demand.

Spain produced nearly 30,000 metric tons of avocados during the 1987-1988 growing season. Two-thirds of the harvest was exported, while the rest was consumed domestically. Spain has become an important producer and exporter of avocados. Its domestic consumption, however, is still very low. The latest available data indicate that Spain's current (1990) average avocado consumption is 272 grams per capita per year. This internal consumption level, being similar and in some cases higher than many other European countries, is still very low for an avocado-producing nation. Israel and South Africa, the other two largest suppliers to the European market, have domestic markets which are much more developed than Spain's. France, although not a producer, is the biggest consumer in the European Economic Community (EEC) and their avocado consumption is five times higher than that of Spain.

The trend of avocado consumption in Spain, however, is rising; and although not as rapidly as in France's, it still is slightly higher than the EEC average. Additionally, this rise is occurring without any type of promotion or advertisements, with the exception of short sporadic actions.

As a producing nation, Spain wants to increase its domestic avocado consumption. This would serve as an important source of demand to add to that of the rest of the EEC. Thus, the sale of Spanish avocados could depend not primarily on export demand, but rather the domestic market would serve as an "escape valve" for that portion of the crop that is not exported. The development of an internal market, therefore, seems to be a key element in the production and marketing strategy of the Spanish avocado producer/industry.

Based on these premises, it seems to be worthwhile to study the structure of avocado consumption in Spain. In 1988, the Project INIA 8205 was initiated with one of its objectives to carry out an analysis of the market potential for the Spanish-produced avocados, and therefore an analysis of Spain's own domestic market.

There are several antecedents regarding the analysis of the Spanish avocado market that were made before 1988: Rolo (1981), and Calatrava and Lopez-Nieto (1981) who analyzed the initial phases of the market's development. From the results of the project mentioned previously, Calatrava and Gonzalez-Roa (1988) analyzed the structural change that occurred in the Spanish market between 1984 and 1986. Calatrava (1990) analyzed the consumption of avocados in restaurants and its evolution during the 1980's.

Finally, Calatrava and Gonzalez (1991) carried out a detailed analysis of the Spanish market structure, based on the results of all the studies mentioned above and on surveys of retailers and consumers made between 1989 and 1990.

The present study is a partial and preliminary summary of some of the more general results from the surveys of consumers, since at the time of printing only 1099 replies, picked by chance among the 1454 questionnaires carried out had been analyzed.

Materials

and Methods

Although the majority of the information that is utilized in this study is first-hand, corresponding to the analysis of a relatively new product on the market of which consumption is still low, some previously published data has been used. These include, the statistical periodicals from SOIVRE (CICE from Granada) and data from the Boletines Mensuales (monthly bulletins) sent by the administration of MERCASA (Spanish public corporation for agricultural product marketing).

Only some comments of this text will be provided by the surveys of the retailers and restaurants. The majority of the content is based on the information gathered from the surveys to consumers. The poll was taken from 1,445 consumers who responded to a questionnaire sent by mail to 6,742 addresses, which were previously stratified by region, size of populations (i.e. metropolitan (>100,000 inhabitants), urban (20,000-100,000), semi-rural (5,000-20,000), rural «5,000 inhabitants), and by neighborhood of the most important metropolitan areas.

The responses received, which maintain the statistically significant initial stratification, allow for the making of inferences of intermediate proportions (40-60%) with an error of less then 2.62%; and of extreme proportions (10-90%) with an error of less then 1.57% (in both cases with a probability (P<0.955). Great care was taken to minimize the sample errors in order to maximize the applicability of the inferences made to the Spanish population as a whole. Logically, the affirmations that were made in this paper refer to reduced fractions of the population which must be understood to be sample descriptions and not as inferences. Upon analyzing here only 1,099 responses, the previous errors are slightly higher; 3.01 and 1.81, respectively.

The survey to consumers is exhaustive and encompasses questions regarding family characteristics, quantity of avocados consumed, frequency of consumption, forms of consumption, motivations, and opinions etc. A detailed analysis of these topics can be found in Calatrava and Gonzalez-Roa (1991). In this paper only some of the more relevant results are described.

Results and

Discussion

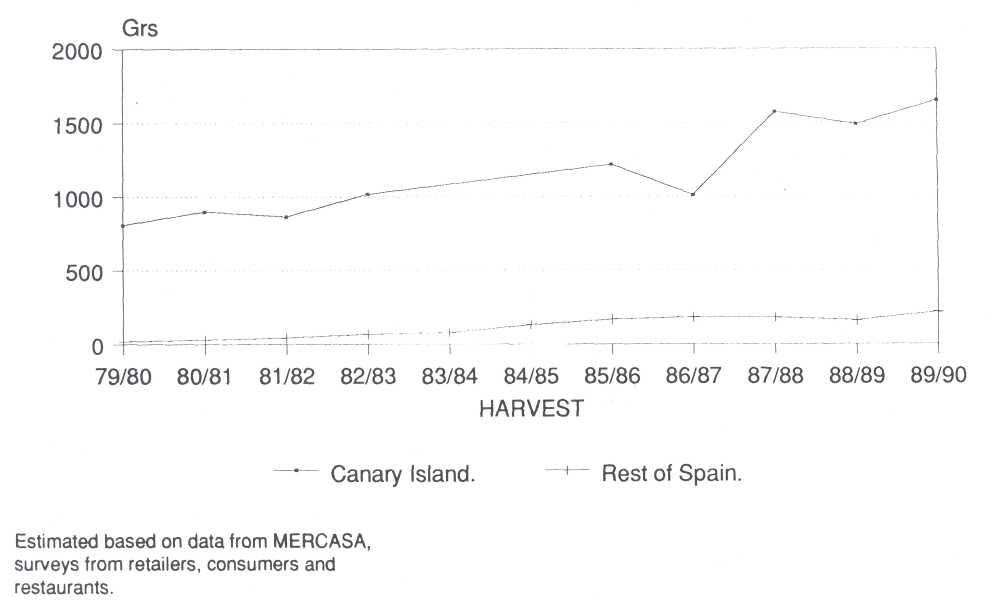

In order to accurately analyze the avocado consumption in Spain, one must distinguish between the Canary Islands and mainland Spain. Avocado consumption in the Canary Islands is high, with a rate of 1,650 grams per capita during 1989-1990, 95.8% of the total was consumed by households while only 4.2% was consumed in restaurants. The quantity of avocados consumed by the Canary Island population (scarcely 4% of the total Spanish population) is currently equivalent to 23% of the total avocado consumption in Spain. These data give an idea of the importance of the Canarian market in the overall Spanish domestic consumption. However, the importance of the Canary Island market continues to decrease, since only one decade earlier consumption in the Canary's was 54% of total Spanish avocado consumption. This decline is due mainly to the relative rise in consumption in the rest of Spain.

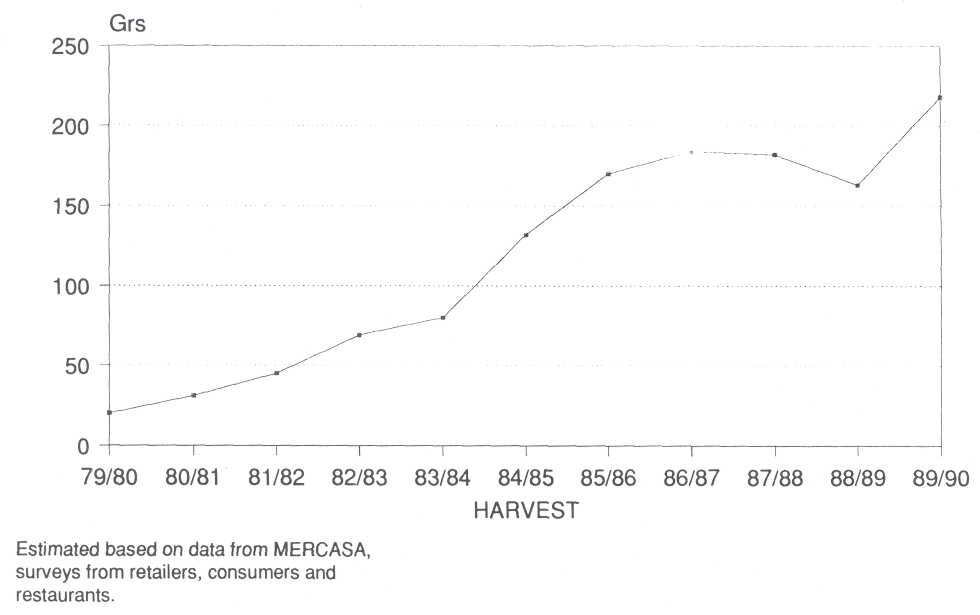

The continental Spanish market, on the other hand, is still fairly small and relatively concentrated in certain geographic areas. This market can still be considered limited, apart from its development which has occurred in the last decade; and in particular its structural transformation between 1984 and 1986. This structural transformation signified the beginning of a certain "popularization" in the consumption of the avocado which began when the avocado stopped being an exotic or luxury product. (Calatrava and Gonzalez-Roa, 1988). Consumption increased from 20 grams per capita in 1981 to 218 grams per capita in 1989/90 and expanded from exclusively certain metropolitan and coastal zones to a much more diverse area of consumption spatially, although still somewhat concentrated. Nearly all (92.5%) of avocado consumption occurs in the home while 7.5% is consumed in restaurants, since no institutional form of avocado consumption yet exists in Spain. The corresponding percentage of restaurant consumption continues to decline, exemplified by the fact that in 1982 restaurant consumption comprised 20% of total consumption in Spain (Calatrava, 1990).

Figure 1 shows the evolution of the Canary Island per capita avocado consumption and that of the rest of Spain during the last decade. We see the trend rising in both cases. In Figure 2, we see in more detail the evolution of per capita consumption in continental Spain.

By considering Spain overall; the quantity of

avocados consumed during the 1989/90 harvest season (Sept.-August) has been

10,923 metric tons which amounts to a figure of close to 280 grams per capita.

This quantity could be increased slightly considering that small amounts of

avocado imports (not registered as such) enter Spain, by way of transportation

of other fruits and vegetables generally from other EEC nations. These are

small quantities that are difficult to estimate, but whose existence not

withstanding is known. Diaz-Robledo (1991) takes this fact into account in his

estimate of per capita consumption of 286 grams. This consumption level places

Spain at a similar level to that of Germany, Great Britain, and Denmark.

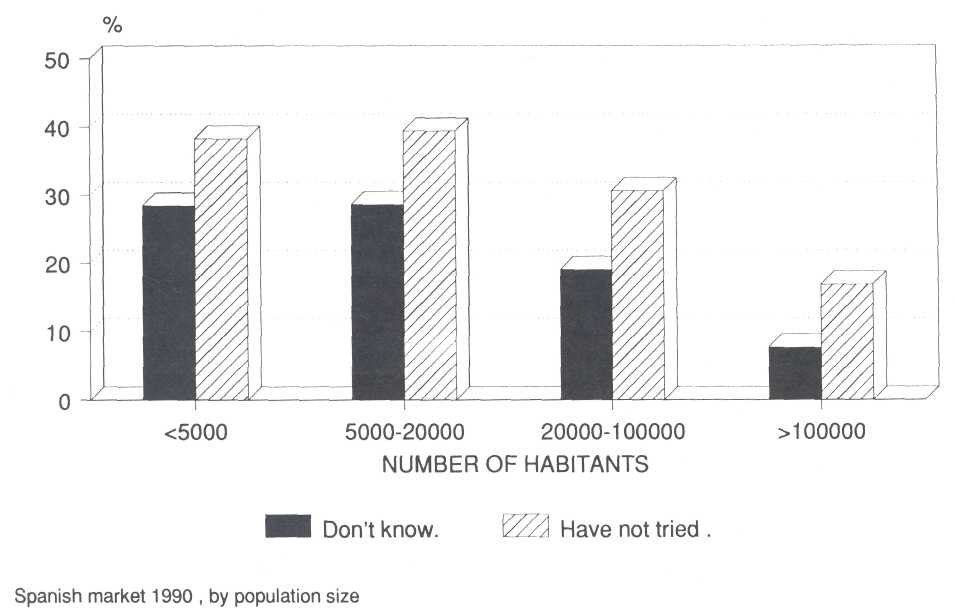

Level of recognition and consumption. The vast majority (82.13%) of the persons polled knew what the avocado was and could identify it. This level of recognition is fairly high and in Europe is only below that of the French. This percentage does vary significantly spatially within Spain, with a maximum (100%) in the Canary Islands and the minimum (between 50-55%) in the regions of Castilla-La Mancha, Extremadura, and Galicia. The figures relating to consumption, however, are much lower. One-third of the Spaniards surveyed (29.4%) had never tried the avocado, and half (49.06%) had either not tried it or had eaten it once and not tried it again because they did not like it. This percentage, being higher than that of the French (23%), is however less than that of the English (1988: 73%), Germans (1987: 77.7%), and more similar to that of the Danes (61.3%) and Swedes (55.8%); according to reports from AGREXCO, based on marketing studies made in those countries. Not knowing the survey characteristics (sample sizes, stratifications, etc.) since they were not published, renders it impossible to make precise comparative inferences. Those that eat the avocado sporadically (once a year on average) comprise 36.8% of the population while 11.05% say they consume it with greater frequency but only occasionally. Finally, only 3.04% consider themselves regular consumers, these being basically from the Canary Islands, the Mediterranean Coast and Balearic Islands, and Madrid and Barcelona. These are the regions that register the highest levels of recognition and consumption. The unit of País Vasco, Navarra, and Rioja reflect a level of recognition of the avocado which is much higher than the national average. However, they had a consumption level less than the national average, in contrast to the relationship between recognition and level of consumption which exists in the other regions considered in the analysis. The levels of recognition and consumption vary themselves as a function of the type of population, with the highest levels of recognition and consumption in the metropolitan zones, but with no significant statistical differences between rural and semi-rural populations. Figure 3 clearly shows these differences for the recognition of the avocado and the cases of having or not having tried it.

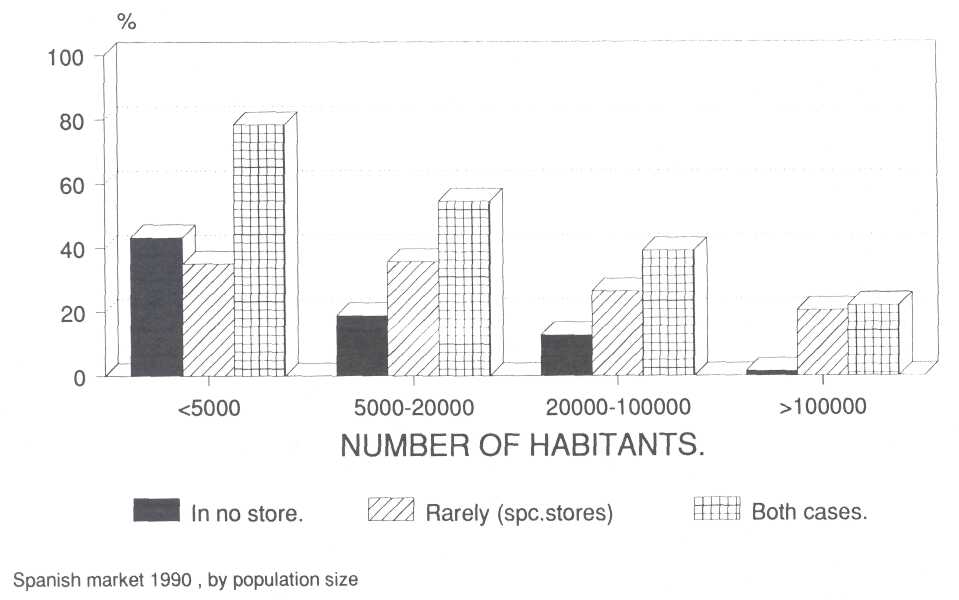

Availability of the avocado in the marketplace. A sizeable fraction of the population (40.03%) of those surveyed responded that they either had never found the avocado in their local market (14.45%) or found it sporadically and only in specialty stores (25.85%). Nearly a third (29.85%) affirm finding avocados in only some stores and 30.39% said they find them in all or almost all markets. These percentages vary greatly from one zone to another, being related to the previously stated variation in the levels of recognition and consumption of the avocado.

In regards to type of populations, figure 4 clearly shows the differences and it is seen that almost 80% of the citizens of communities with less then 5,000 habitants have problems finding avocados in the marketplace (the remaining 20% refer, in general, to small towns on the Mediterranean coast). This percentage continues to decline, upon increasing the population size, until being only slightly higher than 20% in community sizes of more than 100,000 habitants. To this fact, as previously reported (Calatrava, 1990), it would have to be added that the avocados that arrive in the markets of rural and semi-rural communities are inferior in quality to avocados sold in bigger markets, at times constituting real culls.

Initial consumption. The Spaniards who said they consume avocados were asked when they first tasted avocado. The results are summarized in Table 1.

Responses indicate a rise in avocado consumption in the last few years. The responses from the Canary Islands are logically very different, with 86% of the consumers stating that they had started eating avocados more than five years ago, which is much higher than the national average. It is also higher in the regions of Madrid, Cataluña and the Balearics, Valencia and Murcia, and the coastal zones of Andalucía. The percentage is less than the national average in the rest of Spain and it reaches its minimum in Castilla-La Mancha, where only 14.65% of consumers started using avocados more than five years ago. In the areas of lesser recognition and consumption, the initiation of avocado consumption has been a more recent phenomenon, which is important since it indicates a dynamic element in the development of the consumption market.

The survey participants were asked the reason that they first tried avocado. The results are presented in Table 2. We see that the factors leading to the initial consumption of the avocado are diverse, with the leading responses being "recommended by a friend" and "saw it in the store." This calls to attention the little importance the recommendation of the retailer has, as a factor of introduction to the consumption of the avocado. This also reflects how unknown the avocado is (forms of consumption, preparation, varieties etc.), which is detected at this level (Calatrava and Gonzalez-Roa, 1991).

The majority of Spaniards tried the avocado for the

first time: by eating it plain (38.99%), in salad (35.72%), or filled with

seafood (15.47%). Thus, a statistically significant relationship was detected

between eating it raw for the first time and not trying it again, due to dislike.

This relationship is important for the design of a promotion and advertising

strategy for the avocado, and already had been detected in 1980 by Calatrava

and Lopez Nieto (1981) in the first studies of the development of avocado

consumption in Spain.

Repeat consumers of avocado were asked what form their consumption took. These results are summarized in Table 3. Comparing these figures with those given by AGREXCO for the French market, the results are found to be similar with the important exception of avocado consumption in salads; which in Spain is very widespread while in France only 8.5% of consumers eat avocados in this form. There is also another difference in that the French consumer eats them often in salsas, purees, guacamoles etc., while this form of consumption scarcely exists in Spain.

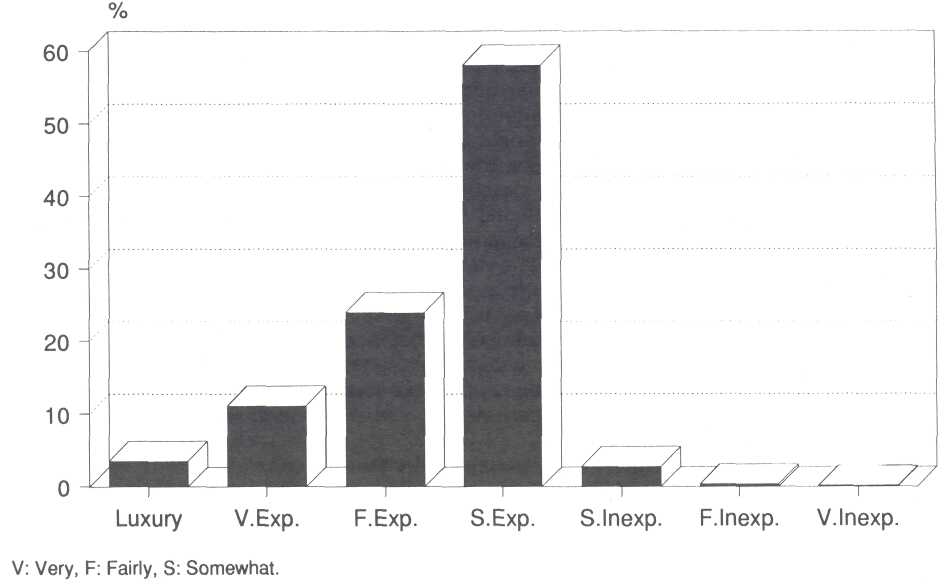

Opinions regarding the price of the avocado. The opinions of Spaniards about the relative price

of the avocado, in relation to other fruits and vegetables, leaves no doubts as

97% of those surveyed consider theproduct

to be expensive. Of these, 83% think it is "somewhat or fairly

expensive" and 14% consider "very expensive or luxury" (see

figure 5). Even though, apart from this, the real price of the avocado has

dropped substantially during the last fifteen years.

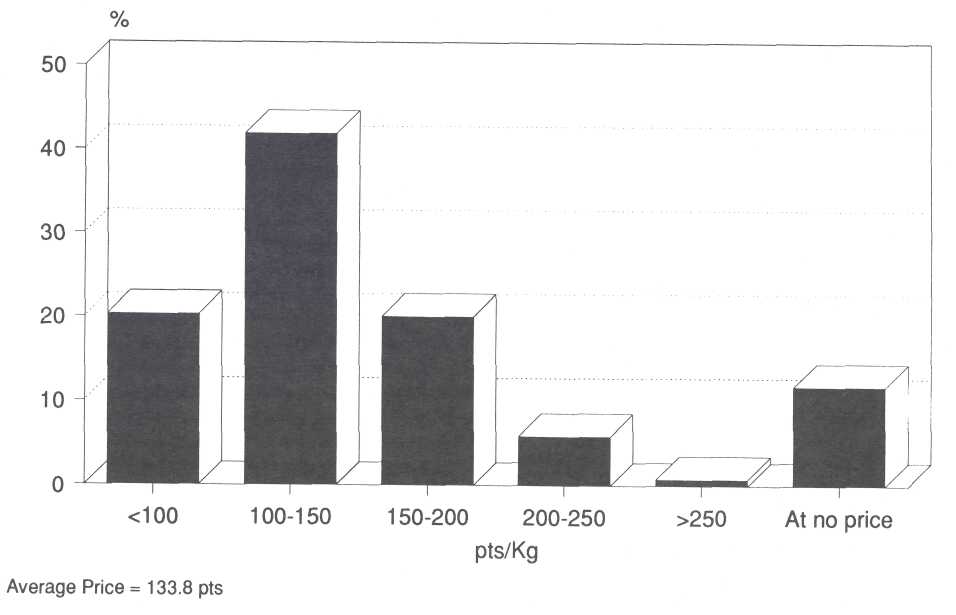

Even

if avocado prices would fall, 11.18% of current consumers would not consume

more avocados. The rest (majority) would increase their consumption with an

eventual lowering of prices. The price at which they would consume avocados

with greater frequency varies, according to a distribution that can be seen in

Figure 6. The average price proposed is 133.8 pts/kg which is absolutely below

the profit margin for producers and retailers. In fact, the consumer price has

been maintained in nominal terms over the last five years, oscillating between

225 pts/kg and 400 pts/kg; with the maximum prices in the summer and the

minimum prices in fall-winter. Except for a small reduction at the producer

level; it is the retail stage which would most be able to reduce its profit

margins, since it is the retailers who are strongly overpricing the avocado as

if it were an exotic or luxury product, with margins that are accustomed to

exceeding 50%. According to the estimates, a reduction of half the retail

margin would cause consumption to increase at the most, between 2,500 and 3,500

metric tons with the current level of knowledge of the avocado and its existing

distribution of supply (Calatrava and Gonzalez-Roa, 1991). Thus, it is the

effect of a greater knowledge of the avocado achieved through promotion and

advertisements, as well as better organization and generalization of the supply

which must induce the adequate development of demand and not primarily the fall

in prices.

Other aspects. A direct relationship has been found between avocado consumption and the level of income, with an elasticity still being estimated. At the same time a significant relationship is perceived between the fact of having two family members working and the consumption of avocados. Possibly, this relationship also exists in terms of the quantity consumed, but this hypothesis is still being tested statistically and, for now, a Tobit model is being fitted. However, there does not seem to be, in any significant form, a relationship between consumption and the number of children in families.

Many of those surveyed complained of the scarce availability of avocados "ready to eat" in the Spanish market which is an evident handicap for more regular consumption.

These and other results, currently being evaluated as is the information derived from the mentioned surveys of retailers and restaurants, and from the analysis of experts (Delphi) currently being carried out, will constitute without a doubt the essential elements that allow for the scientific design of a strategy for the development of the demand for avocados in Spain.

Literature

Cited

AGREXCO: Internal Documents (not published).

Calatrava-Requena, J. 1990. El consume de

aguacate en el sector español de restauración: Estructura actual y evolución en

el periodo 1982-1989. DGIEA., Departamento de Economía y Sociología Agraria.

Serie Documentos de Trabajo #30. Pg. 35 + Anejos

Calatrava-Requena, J. and J. Lopez-Nieto. 1 981.

El consumo español de aguacate: situación actual y perspectivas sobre su posible

evolución. Paper Presented at the VIII Semana Verde de la Costa del Sol. INIA.

Departamento de Economía y Sociología Agraria. Documento de Trabajo #7.

Calatrava-Requena, J. and M.C. Gonzalez-Roa.

1988. El mercado interior de aguacate: situación actual y posibilidades de

expansión. I Jornadas Andalusas de Frutos Subtropicales. D. GIEA., C. Congresos

y Jornadas,Pg. #9.

Calatrava-Requena, J. and M.C. Gonzalez-Roa.

1991. Analysis de la estructura del consumo de aguacate en España: Estrategia

para su desarollo. For Publication INIA (forthcoming).

Diaz-Robledo, J. 1991. Pasado, presente y futuro del aguacate en España. Proc. of the Second World Avocado Congress pp. 645-649.

MERCASA (various years): Monthly Bulletins from the Mercas.

Rolo-Rodriguez, E. 1981. Analysis del mercado

del aguacate. INIA Crida 11. Departamento de Economía y Sociología Agraria.

Documento de Trabajo Vol. 2.

SOIVRE. CICE de Granada (various years):

Exportación de aguacate, Harvest seasons from 1981/82 to 1989/90.

|

Table 1. Distribution of the dates subjects first tasted avocado. |

|

|

Date of First Tasting |

% |

|

Less then 1 year ago |

17.86 |

|

Between 1-2 years ago |

20.67 |

|

Between 2-3 years ago |

16.33 |

|

Between 3-4 years ago |

8.93 |

|

Between 4-5 years ago |

7.53 |

|

More then 5 years ago |

28.69 |

|

Table 2. Reasons given by consumers for trying the avocado for the first time. |

|

|

Reason |

% |

|

Tried it in another country |

12.47 |

|

Recommended by a friend |

25.96 |

|

Saw it in the store and asked for it |

26.39 |

|

Tried it in a restaurant |

16.07 |

|

Suggested by retailer |

5.27 |

|

Other reasons |

13.84 |

|

Table 3. Forms of consumption of avocado by repeat consumers in Spain. |

|

|

Form |

% |

|

Plain |

33.33 |

|

With salt and lemon |

23.51 |

|

Salads |

63.93 |

|

Stuffed w/seafood |

32.87 |

|

Salsa or puree |

2.90 |

|

Dessert (milkshakes, ice cream, etc.) |

8.39 |

|

Other forms |

9.21 |

Fig. 1. Evolution of the per capita avocado

consumption in Spain.

Fig. 2. Evolution of the per capita avocado consumption in Spain (not including the Canary Islands).

Fig. 3. Distribution of respondents who do not know what avocado is and those who have never tried it.

Fig. 4. Percentage of respondents who can't find avocado in their marketplaces.

Fig.

5. Distribution of consumer opinions regarding avocado prices in Spain.

Fig.

6. Price required in order to increase avocado consumption among current

consumers.